Zero-based budgeting

Budget Zen can help you use zero-based budgeting.

Zero-based budgeting is a very simple and effective method to get started with budgeting, if you haven't yet.

What is it?

Zero-based budgeting is a method that requires you allocate all of your money to expenses for needs and wants, as well as short- and long-term savings and debt payments. The goal is that your income minus your expenditures equals zero by the end of the month (hence the name).

The difference between zero-based budgeting and living paycheck to paycheck is that all of your financial goals are met (the first is intentional and mindful, the second is not).

You can repeat expense categories (budgets in Budget Zen) and amounts every month or mix it up. If you come in under budget in a certain category at the end of the month, add the remaining amount to next month's budget or move it to another category, such as your emergency fund. It's the same concept as the envelope system, which involves distributing money for different expense categories into envelopes.

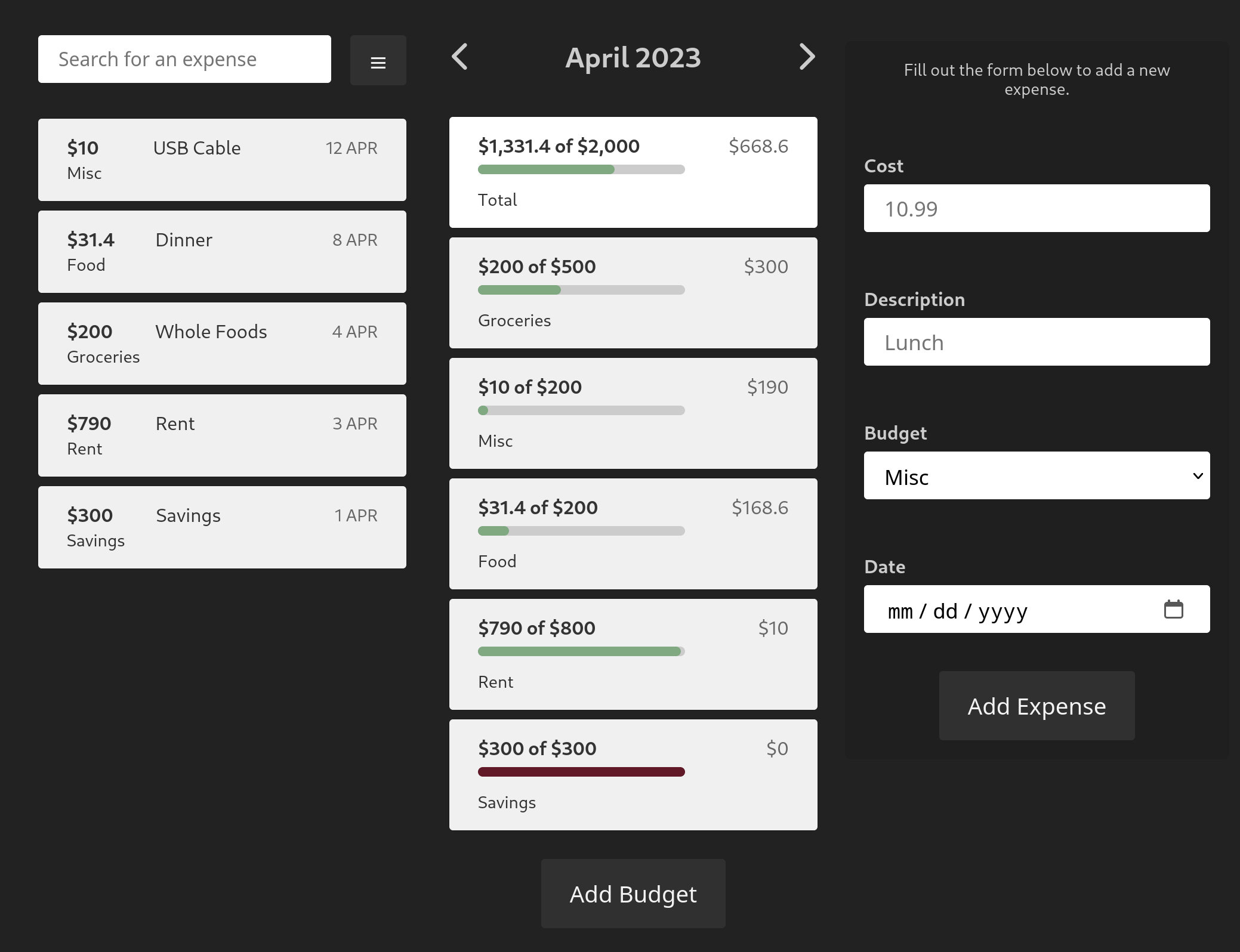

Let's say you make $2,000 per month. Your budget for April might look like this, mid-month:

How do I even get started?

Once you've budgeted for the essentials (rent, bills, insurance, clothing, groceries, retirement), the other spending categories can be for anything else. Want to pay off a credit card in six months? Build it into your budget. Buy a house? Set aside money for the down payment. Big vacation? Pad that travel fund with a few more bucks.

It's important you analyze your expenses and income after taxes and create the appropriate spending categories. For the unexpected/odd expenses, it's best to have a small "Misc" category, too.

How can Budget Zen help me use it?

The budgets in Budget Zen work as the expense categories per month.

You create budgets for each of your expense categories per month and set a budget limit for each one. The "Total" budget at the top should show your income after taxes. You will then be able to track your spending in each budget and get an overview of how much you've got left (and how much you've spent) at any time.

Budget Zen makes it easy to stay on top of your budget and make sure you're not overspending. You can easily see how much money you have left in each category and adjust your spending accordingly. When you open the app you'll quickly see how much money you've got left in each budget and how close you are to spending it. There's also a neat visual indicator that fills up as the budget gets full, and switches from green to red once the limit is reached.

Budgets will be automatically copied to the next month, and you are able to mark expenses as recurring so they're also copied over when the next month comes along. That helps tremendously with planning for things like emergency savings, debt pay-offs, or vacations.

The app also makes it easy to track your spending over time. You can view your spending history for each category and get an overview of your budget over time. This way, you can easily see where you're spending the most money and make adjustments to your budget accordingly, each month.

What about privacy?

Budget Zen is an open source, end-to-end encrypted product, meaning not even we can see your data, only you. That is not the case with most budgeting or expense management tools.

How to try Budget Zen?

You can check out and sign up for the 30-day free trial at the PWA/web app.